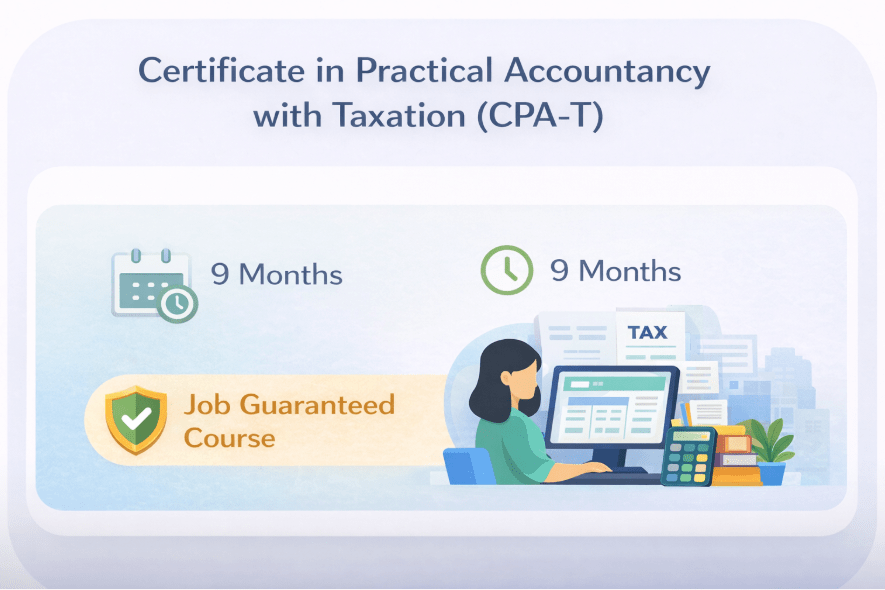

Certificate In Practical Accountancy With Taxation (CPA-T) + AI

Placement Ratio

93%

- Duration : 320 Hours

- Eligibility : Standard 12th

Career Opportunities

🧾 Senior Accountant

💻 Accounts Manager

🖥 Freelancer

Regular & AI Tools You Will Master On

Why Certificate in Practical Accountancy with Taxation & AI (CPA-T)

CPAT will help you to become Accounts Manager, all the market requirements and required skill and tools will be taught here. MS Excel, return filing tools, Income tax with Return Filling, Business Law, Share Trading, Chrome productivity tools, and the latest AI tools used in accounting and finance. AI integration helps you work faster, smarter, and more accurately in today’s digital workplace.

✔ Become Accounts Manager - Salary above 15000/- initially

✔ AI Tools Integrated for Smart Accounting

✔ Designed as per Company Job Requirements

✔ Practical Accounting & Taxation Basics

✔ Job Guaranteed Computer Accountancy Course

✔ Excel, Return Filing & Accounting Software

✔ 100% Career-Focused & Industry Ready

Syllabus of CPAT + AI- (To Become Accounts Manager)

Prime Basic With Accounting

- Basic Accounting (Specially for Non-Accounting Students)

- Download & Installation of Tally Software

- Masters – Groups, Ledgers & Inventory Masters

- Daily Entries – Contra, Receipt, Payment, Sales, Purchase etc.

- Reports – Balance Sheet, P&L, Day Book & Advanced Reports

- Printing, Export-Import, Backup & Restore

- Banking & Related Accounting Terms

- Assignments & Real-Time Projects

Advance Accounting

- Bill-wise Details | Cost Center | Cost Categories | Voucher Class

- Currency – Export-Import Entries & Exchange Handling

- Interest Calculation Automation

- Manufacturing – Costing, Raw Material & Consumption

- BOM | Cost Allocation | Stock Ageing Analysis

- User-wise Security Controls & Permissions

And many more advanced modules…

Prime GST With Accounting

- Introduction to GST

- GST Law

- HSN, SAC, Registration, Supply, E-Way Bill etc.

- Practical and Invoicing of GST

- Purchase, Credit Note, Debit Note and other GST Entries

- Setup for Automation Entry

- Reports – GSTR-1, GSTR-2, GSTR-3B

- E-Way Bill – Setup, Entry, JSON & Dummy Portal Generation

- GST Returns – GSTR-1 & GSTR-3B (Practice Portal)

- GSTR-2A & 2B – Matching & Difference

- GST on Services – Setup, Entry & Reports

Prime TDS Accounting

- Applicability of TDS (Other than Salary)

- PAN Application & Correction – Form 49A

- Sections for TDS Deduction

- Practical on TDS Deduction

- Setup of TDS in Tally Prime

- Masters & Sections – 197, 197A

- Reporting for TDS

- TDS on Goods & TCS

- TDS & GST in Single Entry

Prime Payroll

- Legal Terms – PF, ESI, TDS

- Salary Setup with Taxation

- Reports & Assignments

Soft Skills- Accounts Manager

Basic Computer :

- Basics of Computer – Theory

- Charles Babbage, Processing of Computer, Parts of Computer

- Parts of CPU and their Function

- Input-Output Device and Storage Device

- Typing – Hindi & English

- Working with Computer – Desktop

- My Computer – This PC & Default Folders

- System Configuration, Speed Optimization, Virus & Antivirus

Internet :

- Software – Zoom, Zoomit, Anydesk, Google Meet, TeamViewer, Skype etc.

- Google Tools – Google Form, Google Sheet, Google Docs etc.

- Social Media Apps and their Use for Business

- Internet & Emailing Setup, Signature, Auto Reply, Gmail Settings

- AI, ChatGPT, Cloud Storage, Google Business Manager, AGI, Net Neutrality etc.

- NewSome Important Apps and AI Tools

- IRCTC – Creating ID, Railway Booking & Terms

Microsoft Office with Advance Excel & AI

Microsoft Word

- General Tabs, Projects, Assignment, Word, Excel, Advance Excel

- Projects Work, Financial Calculation, PowerPoint, MP4 Conversion, Outlook

Microsoft Excel

- Introduction, Mathematical & Financial Calculation

- Data Calculation, Office Management

- Accounting Related Sheets & Tabs

Excel with AI

- ChatGPT Integration with Excel

- MIS using ChatGPT with Excel

Advance Excel

- Project Resource Calculation, Data Management, MIS

- VLOOKUP, HLOOKUP, Data Validation & More

Outlook

- Email Configuration, Mailing, Desktop Setup

PowerPoint

- Professional & Official Presentations

- Project Slides, MP4 Videos

Non-Technical - Accounts Manager

Basics of Auditing

Legal Aspects of Company Incorporation

Practical Accountancy

ITR Filling on Dummy Portal

Basics of Share Market Trading

Complete Income Tax with ITR

OTHER COURSES

Certification in Computer Accountancy & Taxation (CCA-T)

Diploma in Computer Application with Taxation (DCA-T)

Prime Expert with Accounting

Prime Taxation Accounting

GST – Taxation with Accounting

Prime Advance with Accounting

Prime Basic with Accounting

Basic Computer Course

Certificate in Practical Accountancy with Taxation- CPAT

Microsoft Office with AI

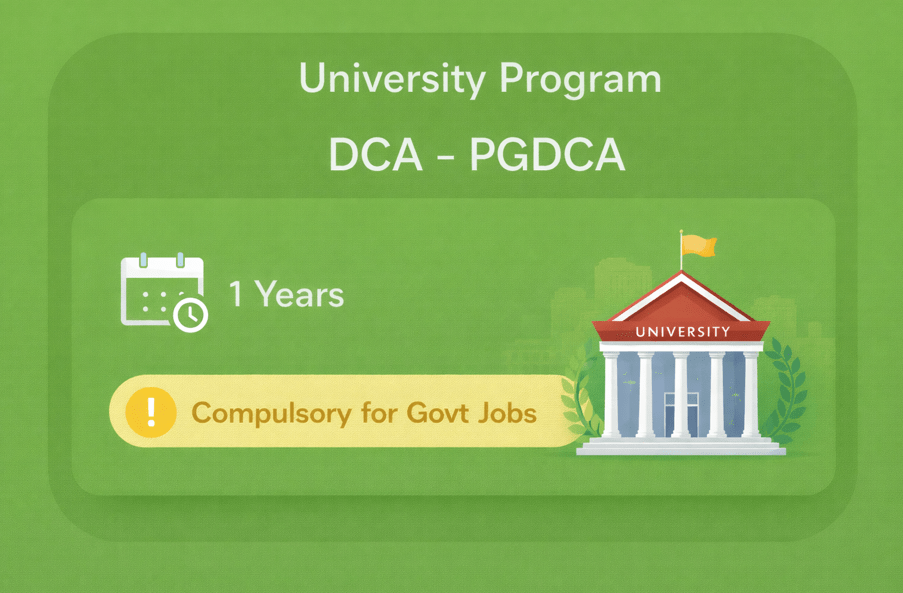

University Program- DCA/PGDCA

Marg Software